Federal marginal income tax rates 2021

The Federal Income Tax is a. 0 would also be your average tax rate.

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

The federal income tax system is progressive so the rate of.

. Import Your Tax Forms And File With Confidence. SINGLE FILERS TAX BRACKETS. Your tax bracket shows the rate you pay on each portion of your income for federal taxes.

MARRIED FILING JOINTLY OR QUALIFYING WIDOW. HEAD OF HOUSEHOLD TAX BRACKETS. Your bracket depends on your taxable income and filing status.

No state has a single-rate tax structure in which one. All the extras are included free. The United States federal tax laws follow a progressive tax system with 2019-2021 marginal tax rate varying from 10 to 37.

See If You Qualify. Ad Time To Finish Up Your Taxes For Free With TurboTax Free Edition. Your Federal taxes are estimated at 0.

Your 2021 Tax Bracket To See Whats Been Adjusted. If you are single and your taxable income is 75000 in 2022 your marginal tax bracket is 22. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly.

Provincial Tax Comparisons summaries of total income taxes payable in each provinceterritory at various levels of employment. 40 680 26 of. Ad Free tax filing software will find your tax bracket for 2021 with guaranteed accuracy.

2021 Tax Brackets by Filing Status. For the 2021 tax year there are seven federal tax brackets. There are seven federal tax brackets for the 2021 tax year.

Discover Helpful Information And Resources On Taxes From AARP. Thirty-two states levy graduated income tax rates similar to federal tax brackets although brackets differ widely by state. Time To Finish Up Your Taxes.

Like the General Schedule payscale which applies to white. Your filing status and taxable income such as your wages determines the. This page lists the various sales use tax rates effective throughout Utah.

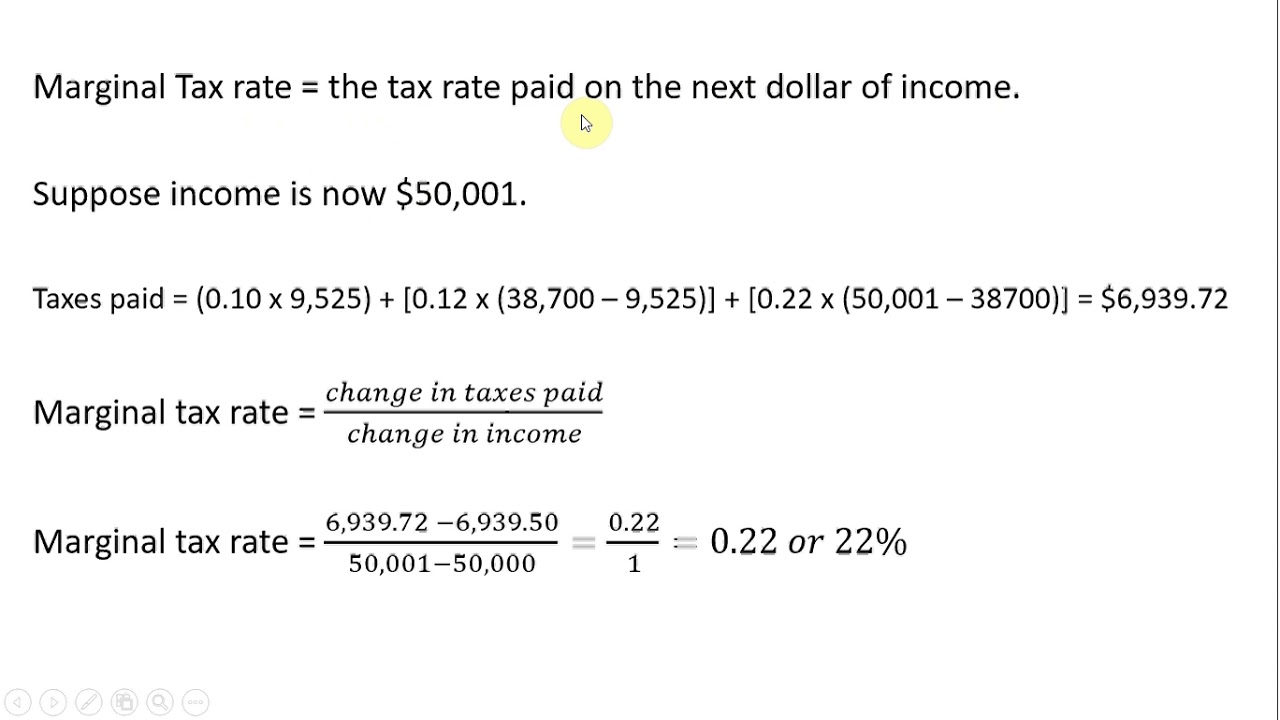

For 2021 tax returns Sarah will pay 6749 in tax. Calculate the amount of income subject to marginal tax rates ie taxable. These are the rates for.

10 12 22 24 32 35 and 37. Income in America is taxed by the federal government most state governments and many local governments. Ad Compare Your 2022 Tax Bracket vs.

15 on the first 50197 of taxable income plus. Examples below use marginal tax rates in effect in 2021 ie associated with 2021 income tax returns generally filed in 2022. This is 0 of your total income of 0.

Guaranteed max refund and always free federal tax filing. There are seven tax brackets for most ordinary income for the 2021 tax year. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

The Providence Utah sales tax is 660 consisting of 470 Utah state sales tax and 190 Providence local sales taxesThe local sales tax consists of a 010 county sales tax a 100. For the 2021 tax year there are seven. For 2018 and previous tax years.

The Federal Wage System FWS payscale is used to calculate the hourly wages for millions of blue-collar Government workers. For many individuals and families calculating federal income tax liability can be broken down into three main steps. Canadas Top Marginal Tax Rates by ProvinceTerritory.

7 rows 2021 Tax Brackets. Updated with tax rates for tax year 2020 due April 2021 Compare the tax year 2020 tax brackets above with the federal brackets for tax year 2019 below. 205 on the next 50195 of taxable income on the portion of taxable income over 50197 up to 100392 plus.

26 on the next 55233. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other. 10 12 22 24 32 35 and 37.

2021 Tax Rate For Single Filers For Married Individuals Filing Joint.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

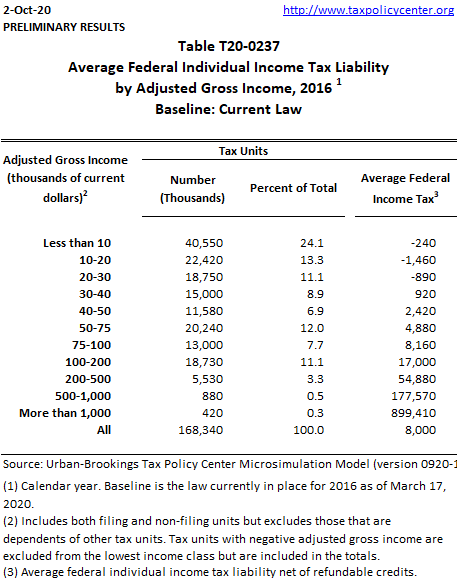

T20 0237 Average Federal Individual Income Tax Liability By Adjusted Gross Income Level 2016 Tax Policy Center

Understanding Marginal Income Tax Brackets Silver Penny Financial

2018 Irs Federal Income Tax Brackets Breakdown Example Married W 1 Child My Money Blog

Feds Raise The Tax Bar Higher For Ny Empire Center For Public Policy

2020 Federal Income Tax Brackets

2022 Income Tax Brackets And The New Ideal Income

Pin On Module Ideas For Aat

2022 Income Tax Brackets And The New Ideal Income

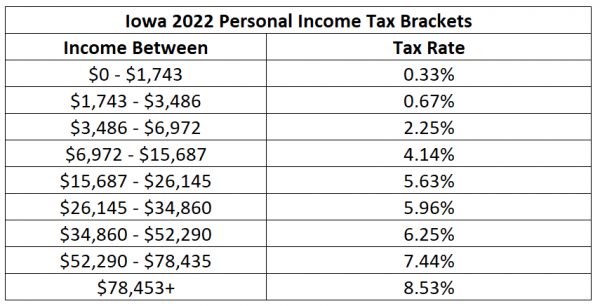

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Federal Income Tax Brackets For Tax Years 2020 And 2021 Smartasset Income Tax Brackets Federal Income Tax Tax Brackets

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Federal Income Tax Bracket What Tax Bracket Am I In Br

2022 Income Tax Brackets And The New Ideal Income

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union